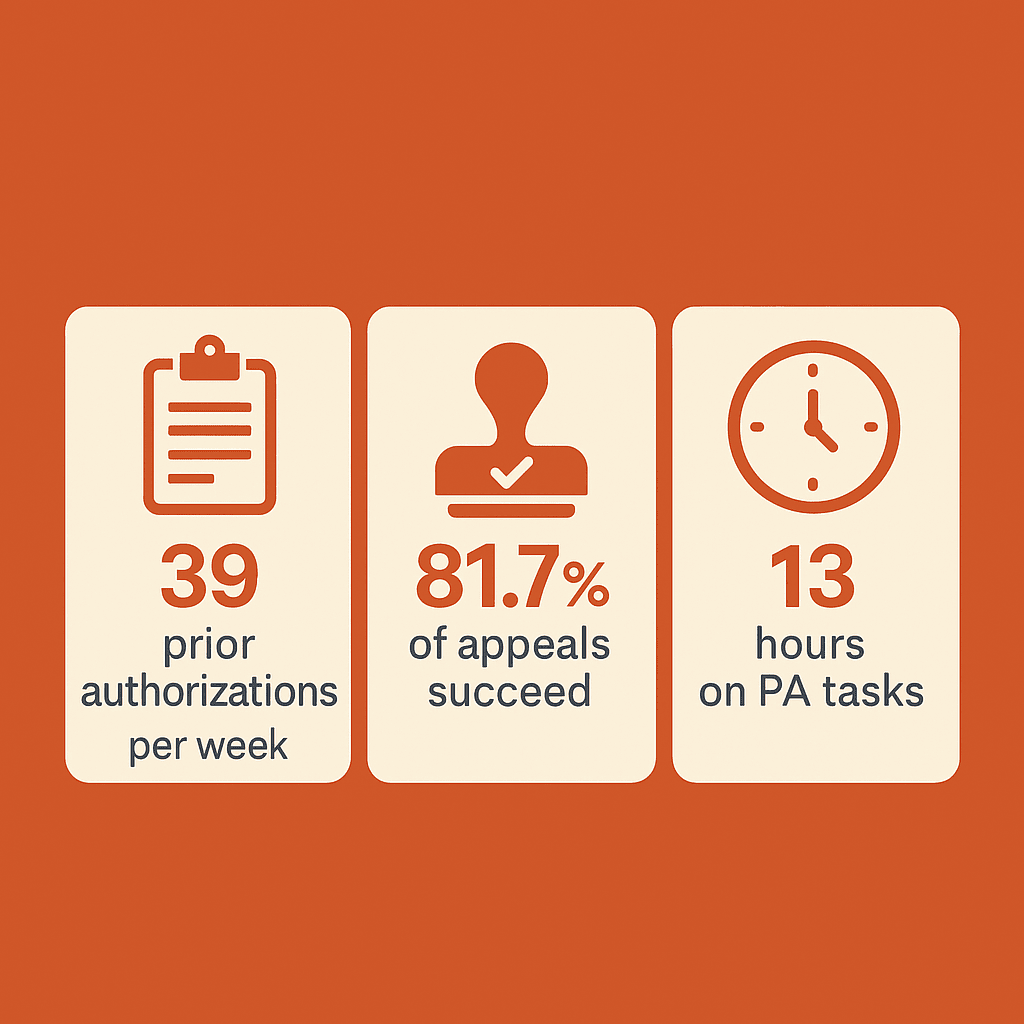

According to the American Medical Association’s 2024 Prior Authorization Physician Survey, physicians complete an average of 39 prior authorization requests per week, consuming 13 hours of physician and staff time weekly (2024 AMA Prior Authorization Physician Survey, American Medical Association, pp. 1-4).

Yet most plastic surgeons accept insurance denials as “the cost of doing business.”

Here’s what the data reveals about your real opportunity cost.

The Hidden Economics of Insurance Denials

The KFF analysis of Centers for Medicare & Medicaid Services data found that Medicare Advantage insurers received more than 50 million prior authorization requests in 2023, with 3.2 million (6.4%) denied initially (KFF Issue Brief, “Medicare Advantage Insurers Made Nearly 50 Million Prior Authorization Determinations in 2023,” January 28, 2025).

Most revealing: of those denials, only 11.7% were appealed, but 81.7% of appeals resulted in overturning the initial denial (KFF Issue Brief, January 28, 2025).

This means practices are losing revenue not because patients aren’t candidates for coverage, but because initial documentation fails to meet insurance medical necessity criteria – and most practices don’t even appeal the preventable denials.

The Critical Staff Communication Breakdown

But there’s a more fundamental problem most practices don’t recognize: staff knowledge gaps that sabotage even medically appropriate cases.

The reality is that most insurance carriers, including Medicare and Medicaid, DO cover abdominoplasty when patients meet established medical necessity criteria. The problem isn’t coverage availability – it’s staff knowledge of what documentation proves medical necessity.

Common scenarios where abdominoplasty receives insurance coverage include:

Diastasis recti with functional limitations – muscle separation causing chronic back pain, core weakness, and inability to perform daily activities

Chronic skin infections and rashes – persistent intertrigo under abdominal pannus that doesn’t respond to conservative treatment

Post-massive weight loss complications – excess skin causing hygiene issues, mobility restrictions, and recurrent medical problems

Hernia repair conjunction – when abdominoplasty is performed simultaneously with medically necessary hernia correction

The Time-Sensitive Revenue Loss Cycle

But here’s where it gets worse: When insurance reviewers call offices for clarification or additional documentation, many of those calls go unanswered or to voicemail.

Insurance reviewers work under strict time constraints. Medicare currently requires prior authorization decisions within 14 calendar days, though new CMS regulations will shorten this to 7 days starting in 2026. Commercial insurers typically allow 72-96 hours for additional documentation requests.

When your medical assistant doesn’t answer the reviewer’s call or fails to return it promptly, the case moves to automatic denial. Not because the patient doesn’t qualify, but because the communication window closed.

The average insurance appeal process reveals the true cost. According to the AMA survey, 93% of physicians report that prior authorization delays patient access to necessary care (2024 AMA Prior Authorization Physician Survey, p. 1). During these delays, practices lose patients to competitors who can navigate approvals more efficiently.

Each lost patient represents far more than a single procedure fee. A typical abdominoplasty patient who goes to a competitor takes with her an $8,000-$15,000 procedure, plus potential revision work, follow-up care, and referrals to family and friends. More damaging: she becomes a walking advertisement for your competitor’s “ability to get things covered by insurance” while simultaneously representing your practice’s “failure to help.” That negative word-of-mouth compounds as she shares her experience with other potential patients in her social circles.

The Expert Solution You Need

As a Registered Nurse with over 20 years of clinical experience and 13 years as a Prior Authorization Specialist, I’ve processed more than 10,000 abdominoplasty insurance cases. I know exactly what documentation insurance medical directors require and how to position cases for approval.

More importantly, I can immediately identify where your current process is failing.

Most practices make the same critical mistakes: using cosmetic procedure language instead of medical necessity terminology, failing to document functional limitations properly, and submitting incomplete conservative treatment histories. These aren’t complex problems – they’re systematic documentation gaps that can be fixed once you know what to look for.

The AMA data shows that 40% of physicians have staff who work exclusively on prior authorization tasks (2024 AMA Prior Authorization Physician Survey, p. 2). Yet these same staff members often lack the specific training needed for plastic surgery procedures that can qualify for medical necessity coverage.

The Dual Solution Advantage

Here’s what sets my approach apart: I don’t just write persuasive marketing copy for your abdominoplasty procedures.

I provide a complete transformation of how your practice approaches insurance approvals. This includes patient education materials that help candidates recognize and document their functional limitations, website copy that attracts patients with legitimate medical indications, and consultation protocols that gather the right documentation from day one.

Most copywriters understand marketing. Few understand the intricate dance between patient psychology, medical documentation, and insurance approval criteria. I bridge all three worlds.

Practices that implement strategic marketing communication typically see significant improvements in patient inquiries and consultation rates. But without proper operational systems, those increased consultations still result in insurance denials.

The Competitive Advantage

While your competitors continue losing qualified patients to preventable insurance denials, you could be capturing both the cosmetic market and the underserved medical necessity market.

The practices that master effective marketing communication don’t just increase revenue – they build referral networks, improve patient satisfaction, and create sustainable competitive advantages.

But there’s something else I offer that most copywriters can’t…

As someone who has personally processed over 10,000 abdominoplasty insurance cases, I’m willing to provide targeted coaching for your medical assistants on proper insurance protocols. Your staff will learn exactly what documentation to include, which CPT codes to use, and how to respond when insurance reviewers call for additional information.

This combination of marketing expertise and operational training creates a complete revenue recovery system that addresses both patient acquisition AND approval success.

The AMA survey data supports this approach: 89% of physicians report that prior authorization contributes to physician burnout, largely due to inefficient processes and repeated denials on appropriate cases (2024 AMA Prior Authorization Physician Survey, p. 2).

Most plastic surgeons will continue accepting insurance denials as inevitable. They’ll keep losing qualified patients to operational failures they don’t even recognize.

But some will realize that the solution isn’t just better surgery – it’s better systems.

P.S. I’m currently accepting three plastic surgery practices for comprehensive revenue recovery development. This includes both strategic marketing communication and medical assistant training protocols. The investment typically pays for itself within 60 days through improved approval rates alone.

View comments

+ Leave a comment